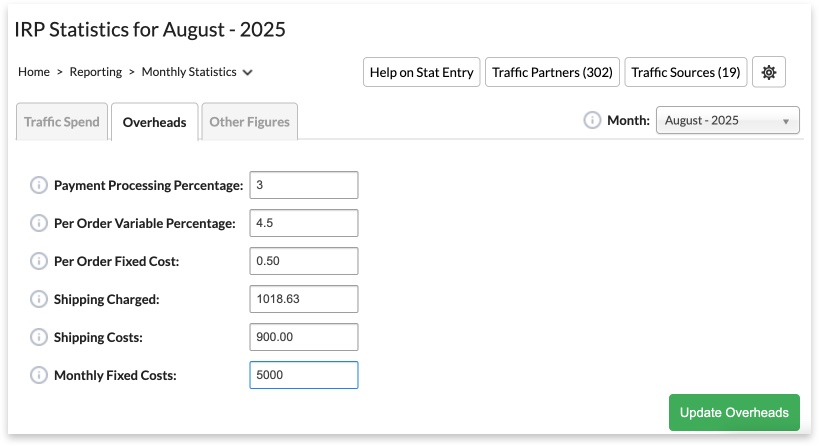

You can find this section under Reporting > Monthly Statistics > in the IRP Shopper Admin left navigation menu.

Adding Overheads enables the IRP Trading Terminal to calculate and display Unit Net Profit. Ecommerce profits are achieved by maintaining Product Margin, controlling Traffic Spend and managing Overheads. The procedure for Submitting Monthly Stats is found here (Agencies only).

Overheads DO NOT include Traffic Costs. Traffic Costs are entered separately in the Traffic Spend tab. The IRP system then combines Traffic Spend and Overheads to acccurately see Unit Net Profit.

Business overheads are the indirect, ongoing expenses to the Merchant. In IRP Overheads includes ALL Costs other than Direct Traffic Spend. These will include items like packaging, shipping, rent, utilities, insurance, staff and other costs.

IRP uses this information to calculate Unit Net Profit (UNP). IRP uses these 'Overhead' figures entered by the Merchant to apply an overhead cost to each unit in an order. Learn more about entering Traffic Costs.

The following maths allows IRP to get to Unit Net Profit:

- Traffic x Conversion Rate x Average Order Value = eCommerce Sales

- eCommerce Sales - Cost of Goods = Gross Profit

- Gross Profit - Traffic Spend = eCommerce Gross Profit

- eCommerce Gross Profit - Overheads = NET PROFIT

- Overheads% applied to Unit = UNIT NET PROFIT

Compiling accurate monthly overhead costs may require the support of finance teams and your IRP Agency. The explanation below explains the data to be entered.

The guide numbers below are to give and example value to set context - and will vary for each Merchant.

Merchants can see if the Overhead they are using are up-to-date by viewing the Traffic Spend / Overheads section at the top of the 'Monthly Statistics' page. Monetary Values are Ex VAT.

| Setting |

Description |

Guide |

| Payment Processing Percentage |

The percentage of each order overall paid to payment providers such as Global Payments and PayPal. This is separate from other Per Order Variable costs such as platform transaction fees. For example, if Global Payment has 1% fee and PayPal a 3% fee then the percentage to attribute per order is 2%. |

2.0% |

| Per Order Variable Percentage |

The percentage of each order overall that you pay to providers, for example platform transaction fee%, any Agency Fee. |

3.0% |

| Per Order Fixed Cost |

The fixed cost of processing each order (irrespective of the number of unit items in the order), including but not limited to packaging and postage labels. |

50p |

| Shipping Charged |

The TOTAL AMOUNT CHARGED to Customers to ship all the orders in the month. * This is pulled from the IRP Orders table - we recommend you leave the figure as it is but you can change if needed. |

E.g. £5,000 |

| Shipping Costs |

The amount PAID to all carriers to ship your orders, For example, if you paid £4,000 in the month to carriers then enter this amount. |

E.g. £4,000 |

| Monthly Fixed Cost |

This is the large Overheads number. This is the fixed cost of running the business, excluding Order Fixed Cost and Shipping Charges. Including but not limited to WAGES, Rent, Rates, Tariffs, Energy and Administration costs. |

E.g., £30,000 |

* NOTE THAT TRAFFIC SPEND is entered separately on the Traffic Spend tab.

Remember - the Owner has complete control WHO sees their Net Profit number. The Agency Will see the number - but the Owner decides who sees Net Profit internally. This can be found in the

IRP Admin > Edit User Group > Show Net Profit.