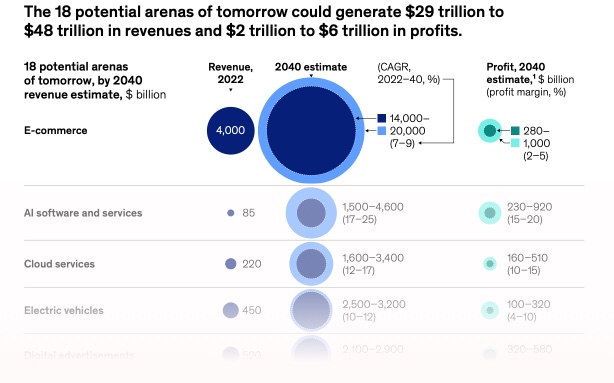

eCommerce as a Market

completely dwarfs AI. A

McKinsey's report shows that by 2040 eCommerce will be a

14-20 Trillion Dollar

a Year Global sector. The downside in eCommerce is that

low profit margins make it less attractive than AI for investors. On the upside eCommerce generates exports and regional trade and spreads economic benefit geographically and across the labour market in a way that NO other industry does.

Margins and Proft remain the BIG PROBLEM in eCommerce . A

recent article suggested an incredible 70% of eCommerce companies go under in their first year. Net Profit Margins remain very thin. IRPs surveyed Merchants reported 8% Net Profit - much higher than the national average. For Northern Ireland based merchants the export opportunity continued to show in the numbers. Northern Ireland's unique position of dual EU and UK market access afforded by the

Windsor Framework is supporting eCommerce. Lower US tariffs applied to the UK may cement Northern Ireland's location as the gateway to two of the World's largest markets in the years to come.

In these KPIs IRP has crunched its data to provide eCommerce Benchmarks for Northern Ireland. With £2 Billion in eCommerce sales for Northern Ireland companies over the years - the 2024 Data provides reference KPIs for NI Merchants on Growth, Conversion, Traffic Costs, Channels, Markets and more for insights on eCommerce trading.

Check out

IRP Market Data for live data at any time.